Checking out results stories of individuals who benefited from Akhuwat loans

Akhuwat, a groundbreaking microfinance establishment in Pakistan, is instrumental in reworking the life of people through its ground breaking loan systems. This informative article delves in the success stories of people who have benefited from Akhuwat financial loans, showcasing how access to monetary assets has empowered business owners, facilitated education and learning, and fostered sustainable livelihoods. By Checking out these impactful scenario experiments, we purpose to lose light-weight over the profound impact of Akhuwat's microfinance model on Group development and individual prosperity.

Introduction to Akhuwat and its Microfinance Product

Akhuwat, a non-profit Corporation situated in Pakistan, is over a mission to eradicate poverty by delivering curiosity-totally free microfinance loans to Those people in have to have. Their design is actually a breath of refreshing air on earth of finance, focusing on compassion and Group upliftment in lieu of income margins.

Overview of Akhuwat's Mission and Objectives

Akhuwat's Main mission is easy yet profound: to empower people today and communities by curiosity-free microfinance, fostering a spirit of dignity and self-reliance. By furnishing fiscal assistance to individuals that need to have it most, Akhuwat aims to break the cycle of poverty and develop a more equitable Culture.

Explanation of Akhuwat's Microfinance Technique

In contrast to classic banks, Akhuwat operates about the basic principle of Qarz-e-Hasna, or benevolent loans, which might be offered with no desire. This distinctive tactic not only will help people today commence or improve their businesses but in addition encourages a lifestyle of supplying again, as borrowers are encouraged to repay the mortgage so Other folks can profit also.

Case Research 1: Empowering Entrepreneurs By means of Akhuwat Loans

Background in the Entrepreneur

Satisfy Ali, a decided younger entrepreneur by using a enthusiasm for sustainable trend. Irrespective of struggling with economical challenges, Ali's goals took flight having an Akhuwat personal loan that served him kickstart his eco-welcoming garments line.

Application Method and Mortgage Approval

Following a demanding but reasonable application process, Ali secured an Akhuwat personal loan that don't just furnished fiscal assist but additionally mentorship to assist him navigate the world of small business. Together with the bank loan authorized, Ali squandered no time in bringing his Innovative vision to everyday living.

Small business Development and Influence on the Neighborhood

Thanks to Akhuwat's guidance, Ali's enterprise flourished, creating task possibilities and inspiring other youthful entrepreneurs in his Local community. Through sustainable techniques along with a motivation to social responsibility, Ali's accomplishment Tale continues to inspire Some others to dream massive.

Circumstance Study 2: Reworking Lives As a result of Training with Akhuwat Assist

Profile of the scholar Beneficiary

Meet Sarah, a established scholar which has a thirst for understanding plus a desire of becoming a doctor. With economic constraints standing in her way, Sarah located a lifeline in Akhuwat's education and learning financial loans, enabling her to go after her tutorial goals.

Instruction Personal loan Utilization and Tutorial Development

With the support of Akhuwat, Sarah was in a position to pay for her tuition charges, purchase textbooks, and give attention to her reports without the burden of financial problems. This aid translated into stellar educational progress, with Sarah excelling in her classes and location her sights over a vivid foreseeable future.

Prolonged-phrase Advantages on Career Development

Now, Sarah's Tale stands like a testomony to your transformative electricity of schooling. Thanks to Akhuwat Loan Apply Online 's aid, she is currently on the path to satisfying her dream of getting a physician, Using the awareness that her results is not going to only benefit her and also her community.

Scenario Study 3: Building Sustainable Livelihoods with Akhuwat Microfinance

Overview on the Microenterprise Operator

Enter Ahmed, a hardworking father and owner of a small food market in his community. Battling to develop his business enterprise because of economic constraints, Ahmed turned to Akhuwat for any microfinance personal loan that will alter his family's fortunes.

Utilization of Funds for Business Expansion

While using the microfinance financial loan from Akhuwat, Ahmed was equipped to purchase extra stock, renovate his keep, and employ internet marketing methods to appeal to extra buyers. This injection of resources reworked his tiny grocery store into a thriving hub of Group activity.

Social and Financial Effect on the Family

The ripple consequences of Akhuwat's guidance had been felt not simply in Ahmed's business but also in his relatives's well-getting. With amplified income and balance, Ahmed was able to supply far better options for his little ones, making sure a brighter potential for another technology. Via Akhuwat's microfinance, Ahmed's journey from wrestle to good results can be a shining illustration of the Corporation's influence on sustainable livelihoods.Impact of Akhuwat Loans on Neighborhood Advancement

Ever questioned how a simple mortgage could completely transform life and uplift full communities? Akhuwat loans have already been instrumental in driving optimistic improve and fostering Local community enhancement. By giving money guidance to persons to start out or expand their companies, Akhuwat has produced a ripple outcome that Added benefits not simply the borrowers but additionally the communities they belong to.

Investigation of Overall Social Affect Metrics

The effect of Akhuwat financial loans goes past just economical numbers. It can be found in the amplified financial action, improved residing requirements, and Increased social cohesion within communities. By examining a variety of social effects metrics such as work prices, cash flow degrees, and usage of basic companies, it will become apparent that Akhuwat loans have played a major part in uplifting communities and making a a lot more sustainable foreseeable future for all.

Results Indicators and Expansion Tendencies

Accomplishment stories of individuals who have benefited from Akhuwat financial loans serve as effective indicators from the good impact of such initiatives. From greater house revenue to improved instruction prospects for kids, the ripple effects of Akhuwat financial loans are very clear. Furthermore, The expansion developments in personal loan disbursements and repayment premiums exhibit the scalability and sustainability of Akhuwat's product in bringing about lasting change in communities.

Troubles and Options in Scaling Akhuwat's Product

Even though the impact of Akhuwat financial loans is simple, scaling this design to succeed in a lot more people today and communities includes its have set of troubles and options. Pinpointing and addressing these hurdles is essential in guaranteeing that the main advantages of Akhuwat financial loans could be prolonged to a bigger population in want.

Pinpointing Key Hurdles in Growth

On the list of important issues in scaling Akhuwat's product is the necessity for increased money means to meet the expanding need for loans. Also, making sure effective monitoring and analysis procedures, as well as addressing cultural barriers and mistrust in economic institutions, are vital hurdles that have to be defeat for prosperous enlargement.

Tactics for Beating Limitations

To handle these problems, employing progressive fundraising techniques, leveraging technological innovation for productive mortgage management, and conducting qualified Local community outreach and consciousness campaigns may also help in scaling Akhuwat's product properly. By building partnerships with nearby organizations and interesting with stakeholders, Akhuwat can navigate the hurdles in expansion and seize opportunities for advancement.

Lessons Learned from Achievements Stories of Akhuwat Loan Recipients

The achievements stories of people who are already empowered via Akhuwat financial loans provide important insights and lessons for sustainable development packages and microfinance initiatives. By comprehending and implementing these lessons, related programs can enrich their influence and make Long lasting modify in communities.

Vital Takeaways for Sustainable Advancement Courses

The achievement stories of Akhuwat personal loan recipients highlight the significance of furnishing not just economic guidance but also mentorship, instruction, and steering to make sure the long-phrase accomplishment of beneficiaries. Sustainable enhancement programs can emulate this holistic approach to empowerment and give attention to constructing ability and resilience in just communities.

Tips for Maximizing Microfinance Initiatives

Based on the experiences of Akhuwat mortgage recipients, recommendations for enhancing microfinance initiatives consist of fostering a culture of believe in and transparency, marketing economic literacy and entrepreneurship expertise, and tailoring bank loan items to meet the diverse requires of borrowers. By incorporating these tips, microfinance institutions can maximize their impact and build alternatives for sustainable economic development.In summary, the inspirational narratives of whoever has thrived Along with the help of Akhuwat loans stand to be a testament towards the transformative ability of microfinance and Local community-driven initiatives. As we mirror on these good results tales along with the broader influence of Akhuwat's mission, we've been reminded in the huge likely for positive transform when economic inclusion and empowerment are prioritized. By continuing to master from these encounters and championing identical initiatives, we will pave just how for a more equitable and prosperous long run for all.

Often Requested Questions (FAQ)

1. How can Akhuwat's microfinance product differ from classic banking financial loans?

two. What requirements does Akhuwat look at when approving loan programs?

three. Can people today from all backgrounds and sectors take advantage of Akhuwat's financial loan programs?

4. How can men and women or communities entry Akhuwat's microfinance services and assistance?

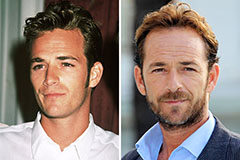

Luke Perry Then & Now!

Luke Perry Then & Now! Loni Anderson Then & Now!

Loni Anderson Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!